Home > Columns > CRM Columns

The Role of KYC in Protecting Customers’ Financial Security

Contributed Article by Sandra Wheeler, Links Tribe

Know Your Customer (KYC) is a critical process employed by financial institutions to verify the identity of their clients.

This process ensures that businesses, especially those in the financial sector, can accurately identify and understand their customers, thereby preventing illegal activities such as money laundering and fraud.

Photo by Andrea Piacquadio:

https://www.pexels.com/photo/cheerful-couple-making-online-purchases-at-home-3756345/

KYC involves collecting and analyzing a customer’s personal

information, such as identification documents and financial activities, to

assess potential risks.

Financial security is paramount for customers, as it

safeguards their assets and personal information from unauthorized access and

fraudulent activities. The increasing sophistication of financial crimes

necessitates robust measures to protect customer data and transactions.

Implementing effective KYC procedures is one of the primary

ways financial institutions can ensure the financial security of their clients,

fostering trust and confidence in the financial system.

What is KYC?

KYC is a regulatory and legal requirement for financial

institutions to identify and verify the identities of their customers.

The process involves obtaining and verifying information

such as the customer's name, date of birth, address, and identification

number.

The primary goal of KYC is to ensure that financial

institutions know who their customers are, understand the nature of their

activities, and assess the risk of illegal intentions.

Key Components and Processes Involved in KYC

- Customer Identification Program (CIP): This involves collecting basic identification information from the customer and verifying its

authenticity using reliable and independent sources.

- Customer Due Diligence (CDD): CDD includes evaluating the

customer's risk profile based on their financial activities and transaction

patterns. It also involves ongoing monitoring to detect and report suspicious

activities.

- Enhanced Due Diligence (EDD): For customers who present a

higher risk, additional information and verification steps are required. This

might include more detailed background checks and closer scrutiny of their financial

activities.

- Ongoing Monitoring and Reporting: Financial institutions

must continuously monitor their customers' transactions to identify any unusual

or suspicious activities. They are required to report such activities to

regulatory authorities.

Importance of KYC in Financial Security

KYC processes play a vital role in protecting customers from

fraud and financial crimes by ensuring that financial institutions can identify

and prevent potentially fraudulent activities.

Photo by Clay Banks on Unsplash

By verifying the identity of customers and monitoring their

transactions, KYC helps detect and prevent identity theft, money laundering,

and other illegal activities.

This not only protects individual customers but also

maintains the integrity of the financial system as a whole.

Examples of potential risks mitigated by KYC:

- Identity Theft: KYC processes verify the authenticity of a

customer's identity, making it difficult for fraudsters to open accounts or

conduct transactions under false pretenses.

- Money Laundering: By understanding a customer's financial

activities, KYC helps detect unusual transaction patterns that may indicate

money laundering.

- Terrorist Financing: KYC procedures ensure that financial

institutions do not unwittingly provide services to individuals or

organizations involved in terrorist activities.

- Fraudulent Transactions: Ongoing monitoring and analysis of

transaction patterns help detect and prevent fraudulent activities, protecting

both customers and the financial institution.

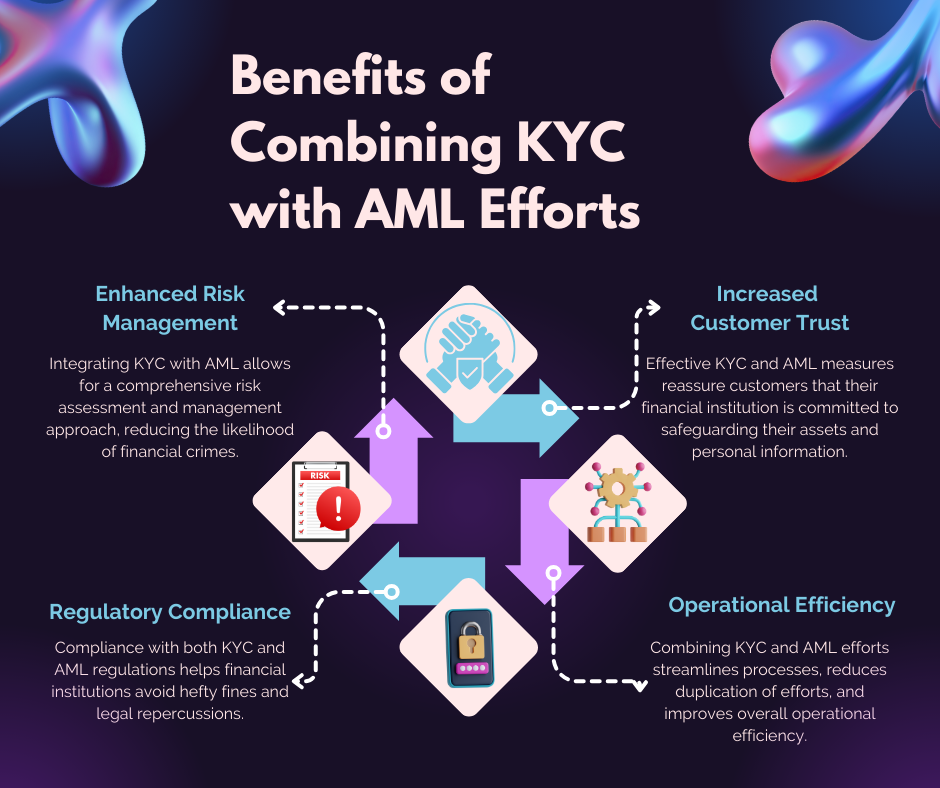

KYC and AML Programs

Anti-Money Laundering (AML) programs are designed to detect,

prevent, and report money laundering activities within financial

institutions.

These programs involve a set of regulations, procedures, and

controls aimed at identifying and mitigating the risk of illicit financial

activities.

AML programs require financial institutions to monitor

customer transactions, report suspicious activities, and maintain records for

regulatory authorities.

How KYC Integrates with AML to Enhance Financial Security

KYC is a fundamental component of AML programs. By accurately identifying and verifying the

identity of customers, KYC provides the foundational data necessary for

effective AML efforts. The integration of KYC and AML involves:

- Customer Risk Profiling: KYC processes help create detailed

customer profiles, which are essential for assessing risk levels and

identifying potentially suspicious activities.

- Transaction Monitoring: AML programs utilize the data

collected through KYC to monitor transactions in real-time, flagging any

activities that deviate from the customer’s normal behavior.

- Reporting and Compliance: KYC ensures that financial

institutions have the necessary information to comply with AML reporting

requirements, such as filing Suspicious Activity Reports (SARs).

Challenges and Solutions in Implementing KYC

Common Challenges Faced by Financial Institutions in KYC

Implementation

Financial institutions face several challenges in

implementing effective KYC procedures. One major challenge is data management,

as collecting, storing, and managing large volumes of customer data can be

particularly difficult for institutions with a large customer base.

Another significant issue is customer experience; stringent

KYC procedures can lead to a cumbersome onboarding process, potentially

affecting customer satisfaction and retention.

Keeping up with constantly evolving regulatory requirements

is challenging and resource-intensive for these institutions.

Technological Solutions and Best Practices to Overcome These

Challenges

To address these challenges, financial institutions can

utilize advanced data analytics and machine learning to manage and analyze

large datasets more efficiently, identifying patterns and anomalies indicative

of fraudulent activities.

Implementing digital KYC solutions, such as eKYC (electronic

Know Your Customer), can streamline the onboarding process, making it faster

and more convenient for customers while ensuring compliance.

Regulatory technology (RegTech) solutions can help

institutions stay up-to-date with regulatory changes, automate compliance

processes, and reduce the risk of non-compliance.

Regulatory Requirements and Compliance

Global regulatory bodies have established stringent KYC

requirements to combat financial crimes and protect the integrity of the

financial system. Key regulations include:

- USA PATRIOT Act (USA): Mandates that financial institutions

implement robust KYC procedures to verify the identity of their customers and

monitor transactions.

- 4th and 5th Anti-Money Laundering Directives (EU): Require

member states to implement comprehensive KYC measures and reporting obligations

to prevent money laundering and terrorist financing.

- FATF Recommendations: The Financial Action Task Force (FATF)

sets international standards for combating money laundering and terrorist

financing, including detailed KYC guidelines.

The Role of Compliance in Ensuring Effective KYC Practices

Compliance with regulatory requirements is essential for

effective KYC practices. Financial institutions must:

- Develop Comprehensive Policies: Establish clear and

comprehensive KYC policies and procedures that comply with regulatory

requirements.

- Regular Training: Provide regular training to employees to

ensure they understand and can effectively implement KYC procedures.

- Continuous Monitoring and Auditing: Implement continuous

monitoring and regular audits to ensure KYC practices remain effective and

compliant with evolving regulations.

- Collaboration with Regulatory Bodies: Maintain open

communication with regulatory authorities to stay informed about changes in

regulations and best practices.

Future of KYC in Financial Security

The future of KYC is being shaped by several emerging trends

and technologies that promise to enhance its effectiveness and efficiency:

- Artificial Intelligence (AI) and Machine Learning (ML): AI

and ML are being increasingly utilized to analyze vast amounts of data quickly,

identifying patterns and anomalies that might indicate fraudulent activity.

These technologies can improve the accuracy and speed of customer identity

verification.

- Blockchain Technology: Blockchain offers a secure,

transparent, and immutable way to store and share customer information. This

can enhance the security of KYC data and streamline the verification process

across different institutions.

- Biometric Verification: The use of biometric data, such as

fingerprints, facial recognition, and iris scans, is becoming more prevalent in

KYC processes. Biometrics provide a higher level of security and are harder to

fake compared to traditional identification methods.

- Digital Identity Platforms: Digital identity solutions are

being developed to create a unified and secure way for individuals to verify

their identities online. These platforms can simplify KYC processes and reduce

the need for repeated verifications across different services.

As financial crimes become more sophisticated, the role of

KYC in protecting financial security will continue to evolve. The integration

of advanced technologies will make KYC processes more efficient, accurate, and

secure.

Financial institutions will need to stay ahead of these

advancements to protect their customers effectively. The future of KYC will

likely see greater collaboration between financial institutions and regulatory

bodies to ensure that KYC practices are robust and adaptable to new threats.

The continuous development of global standards and best

practices will help harmonize KYC procedures worldwide, making it easier to

combat financial crimes on a global scale.

As the digital economy grows, the importance of secure and

efficient KYC processes will only increase, playing a crucial role in

maintaining trust and security in the financial system.

Blockchain Technology: Blockchain offers a secure,

transparent, and immutable way to store and share customer information. This

can enhance the security of KYC data and streamline the verification process

across different institutions.

Biometric Verification: The use of biometric data, such as

fingerprints, facial recognition, and iris scans, is becoming more prevalent in

KYC processes. Biometrics provide a higher level of security and are harder to

fake compared to traditional identification methods.

Digital Identity Platforms: Digital identity solutions are

being developed to create a unified and secure way for individuals to verify

their identities online. These platforms can simplify KYC processes and reduce

the need for repeated verifications across different services.

As financial crimes become more sophisticated, the role of

KYC in protecting financial security will continue to evolve. The integration

of advanced technologies will make KYC processes more efficient, accurate, and

secure.

Financial institutions will need to stay ahead of these

advancements to protect their customers effectively. The future of KYC will

likely see greater collaboration between financial institutions and regulatory

bodies to ensure that KYC practices are robust and adaptable to new threats.

The continuous development of global standards and best

practices will help harmonize KYC procedures worldwide, making it easier to

combat financial crimes on a global scale.

As the digital economy grows, the importance of secure and

efficient KYC processes will only increase, playing a crucial role in

maintaining trust and security in the financial system.